I have checked my mailbox and found that some of the newsletters are suitable for trading. These are:

ADVFN newsletters

GCI Financials - not too useful but at least gives some info.

Forexnews.com

GFX Group and Forex.cf

OTA newsletters

I don't really pay attention to the analyses usually. My argument is simply. The puprose of these newsletters is marketing and not my financial profit. However, these letters quite often bring my attention to facts that are interesting. Like I don't trade USD/CAD usually but one of these newsletters brought my attention to CAD. I have checked into it and it was nearly a perfect trade.

Programming Triangle Breakouts

It is about symetrical triangles:

1. Add a volatility indicator of 300 bars.

2. Add a moving avarage of 200 closes.

If 1 goes very low adn 2 goes flat. It is a triangle - most probably. Unfortunatly, it does not filter out sideway market moves... not just triangles. But it is still ok.

Using a stop. We enter the market short or long and change if it was just false breakout.

1. Add a volatility indicator of 300 bars.

2. Add a moving avarage of 200 closes.

If 1 goes very low adn 2 goes flat. It is a triangle - most probably. Unfortunatly, it does not filter out sideway market moves... not just triangles. But it is still ok.

Using a stop. We enter the market short or long and change if it was just false breakout.

High Volume

Ed Ponssi from Online Trading Academy had the following to say:

7 a.m. GMT to 4 p.m. GMT (Greenwich Mean Time, which is the standard measurement of time in the Forex market) is an excellent time for high volume trading, because these are the hours during which traders from London and Europe are most active. Make no mistake about it, London is the world's capital of Forex trading, and is responsible for about 30% of all Forex volume. To be even more specific, the open of the U.K. session (between 3-5 GMT a.m.) and the beginning of the US session (11-13 GMT) have really high volume, as these are the most liquid times of the Forex trading day. I would give respect to breakouts that occur between 7 a.m. GMT to 4 p.m. GMT, and also (to a lesser extent) to breakouts that occur in the early part of the Asian session, around midnight GMT. On the other hand, breakouts that occur during a time of day that is notorious for low volume (late in the U.S. session or late in the Asian session, for example) can be ignored or even faded, because these breakouts tend to occur on relatively light volume.

How about Fibonacci on Forex?

Fibonacci works in Forex trading because it is a part of the Forex trading culture. [Only fib lines no other esoteric fib stuff.]

Basically, I want to use what the institutions use and see what they see, and I want to avoid analyzing anything that institutions do not use. Since institutional traders are the ones that move the market, we want to align our analysis with theirs.

For me, the bare minimum time frame for a Fibonacci retracement would be one day, but when I draw a retracement usually I am covering a period of weeks or months. Again, try to pick the one that seems most obvious...which one really sticks out? That's the one that most people will use, including the institutions and hedge funds, and therefore it is the one that is most likely to work.

NOTE: I Have the e-mail of this guy.

7 a.m. GMT to 4 p.m. GMT (Greenwich Mean Time, which is the standard measurement of time in the Forex market) is an excellent time for high volume trading, because these are the hours during which traders from London and Europe are most active. Make no mistake about it, London is the world's capital of Forex trading, and is responsible for about 30% of all Forex volume. To be even more specific, the open of the U.K. session (between 3-5 GMT a.m.) and the beginning of the US session (11-13 GMT) have really high volume, as these are the most liquid times of the Forex trading day. I would give respect to breakouts that occur between 7 a.m. GMT to 4 p.m. GMT, and also (to a lesser extent) to breakouts that occur in the early part of the Asian session, around midnight GMT. On the other hand, breakouts that occur during a time of day that is notorious for low volume (late in the U.S. session or late in the Asian session, for example) can be ignored or even faded, because these breakouts tend to occur on relatively light volume.

How about Fibonacci on Forex?

Fibonacci works in Forex trading because it is a part of the Forex trading culture. [Only fib lines no other esoteric fib stuff.]

Basically, I want to use what the institutions use and see what they see, and I want to avoid analyzing anything that institutions do not use. Since institutional traders are the ones that move the market, we want to align our analysis with theirs.

For me, the bare minimum time frame for a Fibonacci retracement would be one day, but when I draw a retracement usually I am covering a period of weeks or months. Again, try to pick the one that seems most obvious...which one really sticks out? That's the one that most people will use, including the institutions and hedge funds, and therefore it is the one that is most likely to work.

NOTE: I Have the e-mail of this guy.

High Volume

Ed Ponssi from Online Trading Academy had the following to say:

7 a.m. GMT to 4 p.m. GMT (Greenwich Mean Time, which is the standard measurement of time in the Forex market) is an excellent time for high volume trading, because these are the hours during which traders from London and Europe are most active. Make no mistake about it, London is the world's capital of Forex trading, and is responsible for about 30% of all Forex volume. To be even more specific, the open of the U.K. session (between 3-5 GMT a.m.) and the beginning of the US session (11-13 GMT) have really high volume, as these are the most liquid times of the Forex trading day. I would give respect to breakouts that occur between 7 a.m. GMT to 4 p.m. GMT, and also (to a lesser extent) to breakouts that occur in the early part of the Asian session, around midnight GMT. On the other hand, breakouts that occur during a time of day that is notorious for low volume (late in the U.S. session or late in the Asian session, for example) can be ignored or even faded, because these breakouts tend to occur on relatively light volume.

How about Fibonacci on Forex?

Fibonacci works in Forex trading because it is a part of the Forex trading culture. [Only fib lines no other esoteric fib stuff.]

Basically, I want to use what the institutions use and see what they see, and I want to avoid analyzing anything that institutions do not use. Since institutional traders are the ones that move the market, we want to align our analysis with theirs.

For me, the bare minimum time frame for a Fibonacci retracement would be one day, but when I draw a retracement usually I am covering a period of weeks or months. Again, try to pick the one that seems most obvious...which one really sticks out? That's the one that most people will use, including the institutions and hedge funds, and therefore it is the one that is most likely to work.

NOTE: I Have the e-mail of this guy.

7 a.m. GMT to 4 p.m. GMT (Greenwich Mean Time, which is the standard measurement of time in the Forex market) is an excellent time for high volume trading, because these are the hours during which traders from London and Europe are most active. Make no mistake about it, London is the world's capital of Forex trading, and is responsible for about 30% of all Forex volume. To be even more specific, the open of the U.K. session (between 3-5 GMT a.m.) and the beginning of the US session (11-13 GMT) have really high volume, as these are the most liquid times of the Forex trading day. I would give respect to breakouts that occur between 7 a.m. GMT to 4 p.m. GMT, and also (to a lesser extent) to breakouts that occur in the early part of the Asian session, around midnight GMT. On the other hand, breakouts that occur during a time of day that is notorious for low volume (late in the U.S. session or late in the Asian session, for example) can be ignored or even faded, because these breakouts tend to occur on relatively light volume.

How about Fibonacci on Forex?

Fibonacci works in Forex trading because it is a part of the Forex trading culture. [Only fib lines no other esoteric fib stuff.]

Basically, I want to use what the institutions use and see what they see, and I want to avoid analyzing anything that institutions do not use. Since institutional traders are the ones that move the market, we want to align our analysis with theirs.

For me, the bare minimum time frame for a Fibonacci retracement would be one day, but when I draw a retracement usually I am covering a period of weeks or months. Again, try to pick the one that seems most obvious...which one really sticks out? That's the one that most people will use, including the institutions and hedge funds, and therefore it is the one that is most likely to work.

NOTE: I Have the e-mail of this guy.

Products for Institution

The following are some of the products for institutions (banks, funds, money managers, portfolio managers and their traders). What is unique about these products that they are tailored for the word of currencies. While there are literally thousands of products, most - if not all - fail to address the real needs of institutions and professionals working with currencies. Examples of such failures are many:

Money management

To train the benefits (how to protect capital) and drawbacks of stops (e.g. how they reduce profit or even cause losses with working strategies) a money management education package can be used. Other subjects are: high probability trades, risk-reward ratios, etc.

Currency Trade Simulator using Fundamental Data

Learning currency trading is not possible without the use of fundamental data. Uniquely providing historical fundamental data, the currency trade simulator can "back-test" and "optimize" the trader. Testing, educating him or her on proper use of both technical and fundamental data as well as other forms of analyses correctly use.

Currency Trade Simulator is a sort of time machine. It takes the trader back in time, and he must make his or her trading decisions using technical data and fundamental data without being able to cheat (and look at the next day news or charts).

The only better way to train traders is to let them trader in the present time with real money, however, that is a bit time consuming and sometimes expensive. It is much less time consuming option to take the trader back to the past in a "time machine" and show him the news, charts and other information as it was in the past on that day.

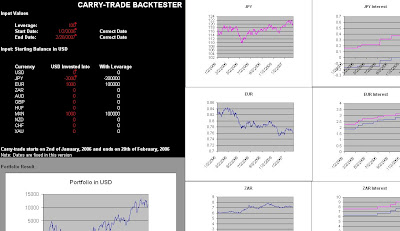

Carry Trade Portfolio Tester

While carry trades are very popular among hedge funds and other institutions, there are practically no testing tools exist to verify currency portfolios covering also interest rate changes and their impact throughout the history of the portfolio.

The Carry Trade Portfolio Back Tester combined with Currency Trade Simulator might be the best tools for some hedge funds to invest their money to verify their trading decisions and educate their traders, portfolio managers, money managers for such a sophisticated trade set up.

- No news feed that are relevant for currency traders. E.g. economic news completely missing.

- Incomplete or missing calendar of important events.

- Even the premium-rate data feeds missing vital data and indices about future markets, or gold markets, or options, etc. and the list is very long.

- While a platform might provide 100+ technical indicators, their relevance to currencies are not considered.

- Vital forms of technical charts missing from charting software.

- No support for back testing currencies with leverage, interest rates, currency-related money management or portfolio back-testing is even completely missing.

Money management

To train the benefits (how to protect capital) and drawbacks of stops (e.g. how they reduce profit or even cause losses with working strategies) a money management education package can be used. Other subjects are: high probability trades, risk-reward ratios, etc.

Currency Trade Simulator using Fundamental Data

Learning currency trading is not possible without the use of fundamental data. Uniquely providing historical fundamental data, the currency trade simulator can "back-test" and "optimize" the trader. Testing, educating him or her on proper use of both technical and fundamental data as well as other forms of analyses correctly use.

Currency Trade Simulator is a sort of time machine. It takes the trader back in time, and he must make his or her trading decisions using technical data and fundamental data without being able to cheat (and look at the next day news or charts).

The only better way to train traders is to let them trader in the present time with real money, however, that is a bit time consuming and sometimes expensive. It is much less time consuming option to take the trader back to the past in a "time machine" and show him the news, charts and other information as it was in the past on that day.

Carry Trade Portfolio Tester

While carry trades are very popular among hedge funds and other institutions, there are practically no testing tools exist to verify currency portfolios covering also interest rate changes and their impact throughout the history of the portfolio.

The Carry Trade Portfolio Back Tester combined with Currency Trade Simulator might be the best tools for some hedge funds to invest their money to verify their trading decisions and educate their traders, portfolio managers, money managers for such a sophisticated trade set up.

Saxo FX news providers

News Providers of Saxo:

AFX Financial News

Market News International

Strategies:

UBS Fundamental Strategies

Commonwealth Bank Fx Analysis

Barclays Bank FX Analysis

Global Strategic Note

AFX Financial News

Market News International

Strategies:

UBS Fundamental Strategies

Commonwealth Bank Fx Analysis

Barclays Bank FX Analysis

Global Strategic Note

Saxo FX news providers

News Providers of Saxo:

AFX Financial News

Market News International

Strategies:

UBS Fundamental Strategies

Commonwealth Bank Fx Analysis

Barclays Bank FX Analysis

Global Strategic Note

AFX Financial News

Market News International

Strategies:

UBS Fundamental Strategies

Commonwealth Bank Fx Analysis

Barclays Bank FX Analysis

Global Strategic Note

Subscribe to:

Posts (Atom)